Canada’s December 2025 Labour Force Survey: A Deep Dive into the Year-End

Understanding Canada’s December 2025 Labour Force Survey: A Year-End Shift

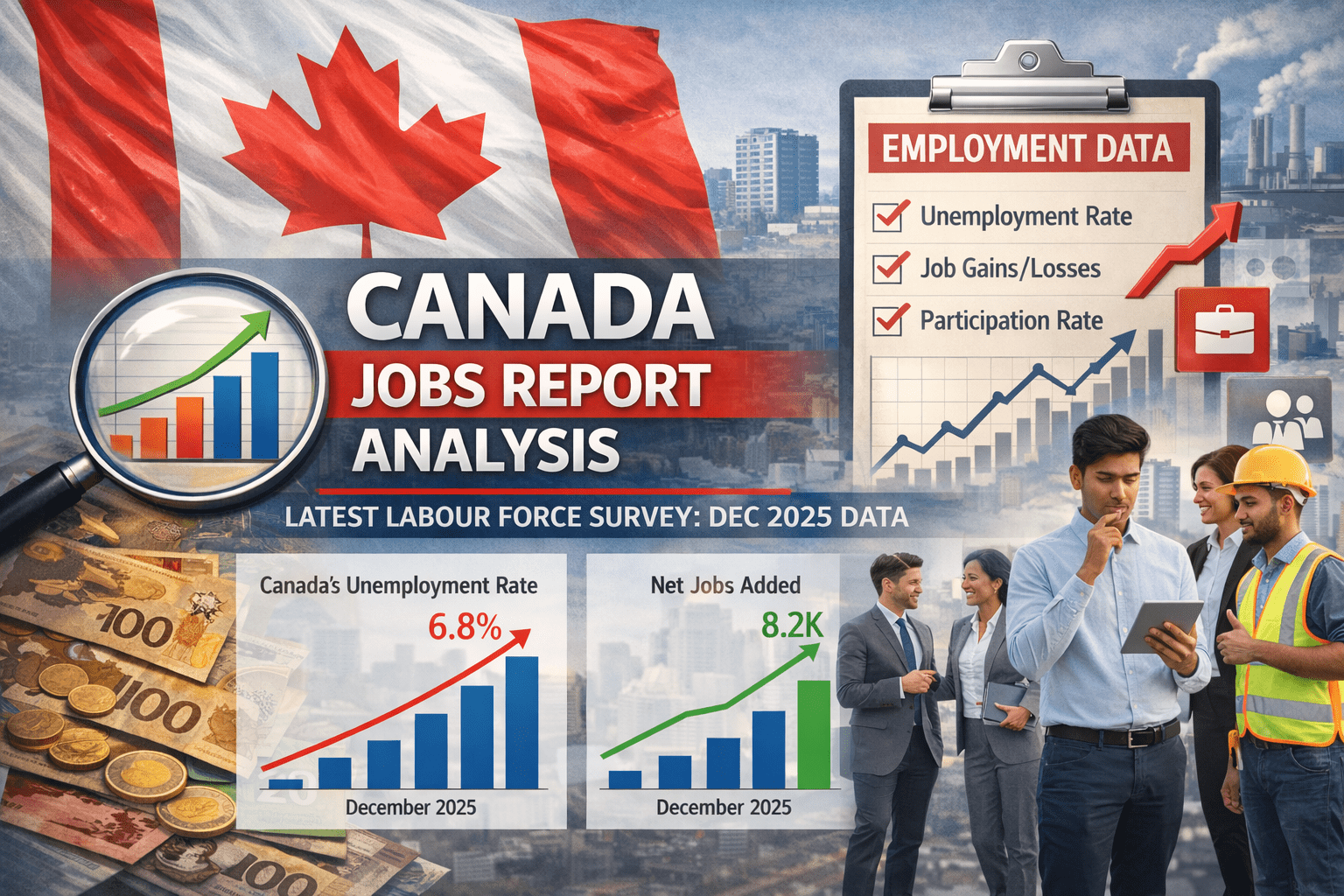

The final chapter of 2025 has officially closed, and the latest data from the December 2025 Labour Force Survey offers a compelling look at where the Canadian economy stands. While the year was marked by significant geopolitical shifts and trade-related headwinds, the December report provided a mix of caution and optimism. According to Statistics Canada, the national unemployment rate rose to 6.8 per cent, up from 6.5 per cent in November, creating a complex narrative for job seekers and policymakers alike.

The Headline Numbers: A Closer Look at the Data

The primary takeaway from the December 2025 Labour Force Survey is the noticeable jump in the unemployment rate. This 0.3 percentage point increase represents roughly 1.6 million Canadians currently looking for work. However, economists are quick to point out that this rise isn’t necessarily a sign of a crashing economy. Instead, it was largely driven by a surge in the number of people re-entering the workforce.

Interestingly, the economy still added a net 8,200 jobs during the month. While this was a modest gain, it actually outperformed many analyst predictions that suggested we might see a net loss. The rise in the unemployment rate occurred because the growth of the labour force—those actively looking for work—simply outpaced the number of new positions available.

Full-Time Growth vs. Part-Time Declines

When we peel back the layers of the December 2025 Labour Force Survey, we see a significant shift in the type of work being found. December was actually a strong month for full-time employment, which saw an increase of 50,000 positions. This is a positive sign for long-term economic stability, as full-time roles typically offer more security and higher wages.

Conversely, part-time employment took a hit, shedding approximately 42,000 roles. This decline offset the massive part-time gains seen in October and November. For many, this correction was expected, as the labour market sought a new equilibrium following a volatile autumn.

Sector Winners and Losers

Not all industries experienced the end of the year in the same way. The December 2025 Labour Force Survey highlighted specific sectors that remained resilient despite broader economic pressures:

Healthcare and Social Assistance: This sector continued its growth streak, adding 21,000 jobs.

Construction: Added over 11,000 roles, signaling continued investment in infrastructure and housing.

Manufacturing: Despite the looming “trade war” and U.S. tariff concerns, this sector managed to add 4,300 jobs.

On the flip side, professional, scientific, and technical services saw a decrease of 18,000 positions, marking a rare cooldown for a sector that has historically been a growth engine for the Canadian economy.

The Youth Employment Challenge

Perhaps the most concerning aspect of the December 2025 Labour Force Survey is the ongoing struggle for younger Canadians. The youth unemployment rate (for those aged 15 to 24) climbed to 13.3 per cent. While this is an improvement from the staggering 14.7 per cent seen earlier in the autumn, it highlights a persistent “hiring appetite” gap.

Young workers were the hardest hit by the decline in part-time work, and many new graduates are finding that entry-level opportunities are more competitive than ever. Economists suggest that while the “slack” in the market is being absorbed, it is happening gradually, leaving many young people on the sidelines for longer than expected.

Economic Outlook: What This Means for 2026

As we move into a new year, the results of the December 2025 Labour Force Survey will be a key factor in the Bank of Canada’s upcoming interest rate decisions. With the unemployment rate sitting at 6.8 per cent, there is evidence of “slack” in the economy, which usually gives the central bank room to consider holding or even lowering rates to stimulate growth.

However, wage growth remains a factor. Average hourly wages rose by 3.4 per cent year-over-year in December. While this is a cooling from previous months, it still represents a steady increase in purchasing power for those currently employed, which the Bank of Canada must balance against inflation risks.

Final Thoughts on the Labour Market

The December 2025 Labour Force Survey paints a picture of a Canadian labour market that is “choppy” but recovering. The transition from 2025 to 2026 is defined by a workforce that is more optimistic and active, even if the immediate job openings haven’t caught up to the number of applicants.

For the average Canadian, the message is one of cautious persistence. The economy is adding full-time jobs, and key sectors like healthcare remain hungry for talent. While the headline unemployment rate of 6.8 per cent may look daunting, the underlying trend suggests a market that is stabilizing after a year of unprecedented trade uncertainty. As 2026 unfolds, all eyes will remain on how effectively the Canadian economy can turn this renewed labour participation into long-term employment growth.

Check out our latest news updates: Iran Protests 2026: 116 Killed as Death Penalty Threat Intensifies